https://bondvigilantes.com/wp-content/uploads/2024/06/1-the-journey-to-qn-1024×576.png

We have written many times on QE (Quantitative Easing) and QT (Quantitative Tightening); however, we have never talked about QN. QN is the ultimate goal for central banks – but what exactly is it?

The ‘N’ in QN stands for Neutral. In a steady state of economic growth, money must be printed to facilitate inflation in the economy. In this steady state, there is a simple requirement to have enough money tokens in the system to achieve the desired growth in the nominal GDP of the country, which is defined as the combination of real growth and inflation.

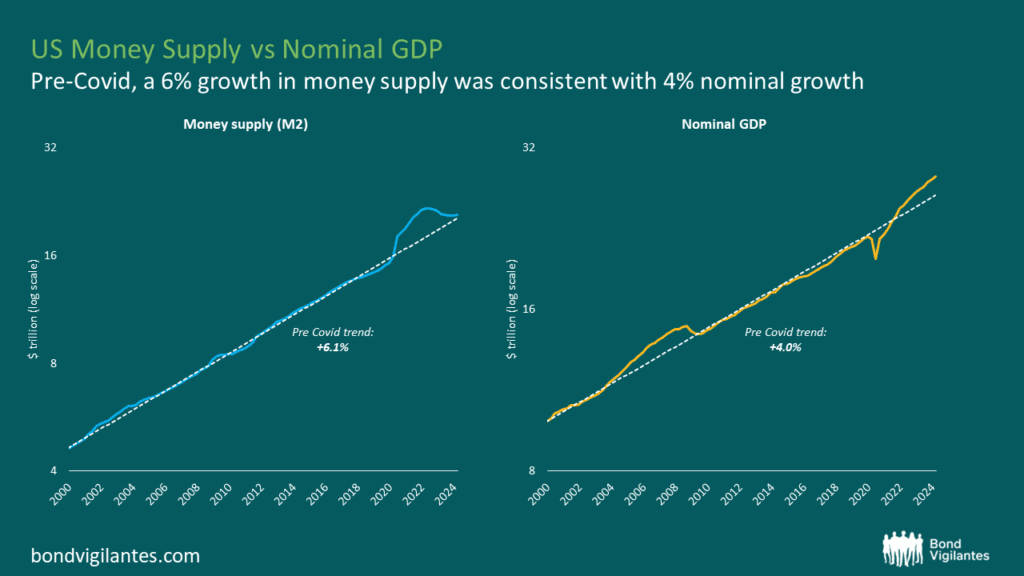

We can plot this monetary policy stance over time by showing money supply growth vs nominal GDP. In the chart below we can see that the US Central Bank normally pursues a 6 percent annual growth in money supply to achieve 4 percent growth in nominal GDP, composed on average of 2 percent of real growth and 2 percent of inflation.

Given the series of economic events over the course of the first quarter of this century, unconventional monetary policy has been regularly occurring. QE has been in operation on and off over much of the period, in order to facilitate stable growth in the money supply. As mentioned earlier, in the 20 years prior to Covid, the Fed generally succeeded in maintaining a stable level of money supply growth. However, the aggressive QE measures implemented since Covid have led to a significant increase in the money supply, contributing to the subsequent inflationary pressures.

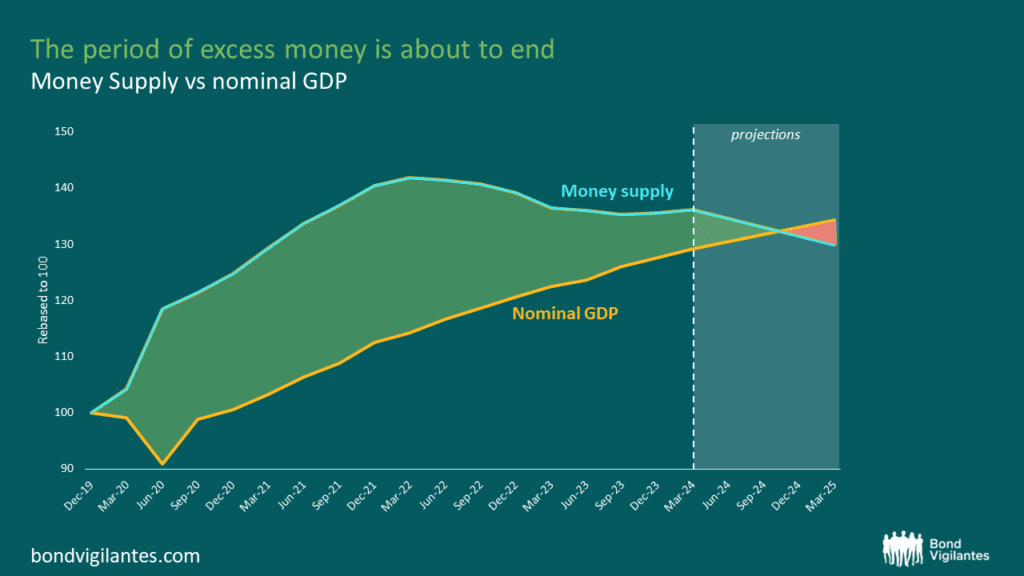

Since June 2022, the Fed has reversed its course and initiated a round of QT to gradually reduce the amount of money in circulation.

The question now is, how much more do they need to do? If we assume the amount of money in the system should approximate to the size of the economy, we need to plot the size of the economy versus the size of money supply to attempt to solve the balance sheet conundrum, which we have done.

In the chart above, we shade the area representing excess money. This excess money will be inflationary in nature, as discussed before here. We can see that QT is getting very close to the point where this excess inflationary money stock is going to disappear. Theoretically, this looks like December of this year. At this point in the stylised picture we provide, monetary policy should be run in a QN framework to allow natural economic growth and inflation of around 2 percent to be facilitated[1].

This move to a more normal monetary approach is something that central banks need to approach over the near term as they transition from a ‘cancel culture’ to ‘business as usual’.

Monetary policy is acknowledged to work with long and variable lags. If we get to December and real QT persists, or the central banks are not expanding the cash in the system at the QN rate, then there would, by definition, be a monetarist argument for inflation to be below their target. If this were to transpire, then inflation would potentially be low enough to encourage significant interest rate cuts.

NET monetary policy matters. Going forward, it will be crucial to understand what central banks will decide to do: will they move to a more Neutral stance? Will they change course completely and adopt a policy of Easing? Or will they opt for continuous Tightening?

[1] To note, the above assumptions are based on the current pace of QT. Whilst the Federal Reserve plans to taper its Quantitative Tightening program, should the pace of QT be reduced, it is likely that the point where the two lines cross could be pushed further back. Further, M2 is influenced by both the Fed and commercial banks through their lending activities; however, for simplicity, the above assumptions are solely dictated by the Fed’s QT, so could be impacted by other factors. Despite this, given high interest rates and lower lending activity, it is likely that the Fed’s QT will be the dominant factor impacting M2 levels in the short term.