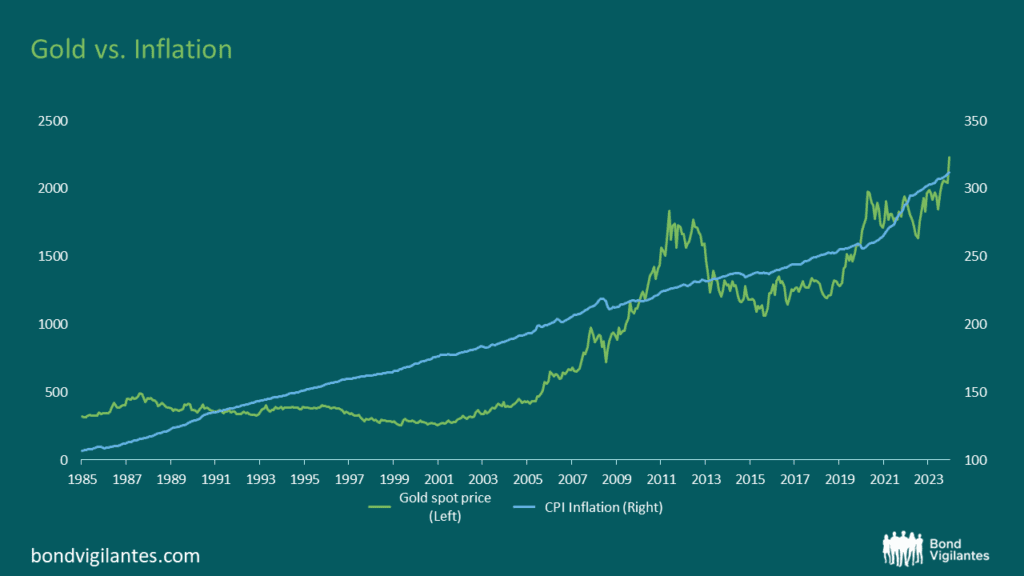

Famend for its function as a hedge towards financial uncertainty and inflation, gold has lengthy captivated buyers. One key issue influencing gold’s value is the connection between actual yields and inflation. Over the long run, gold has protected one towards the pernicious results of inflation and stays a strong diversifier inside an funding portfolio:

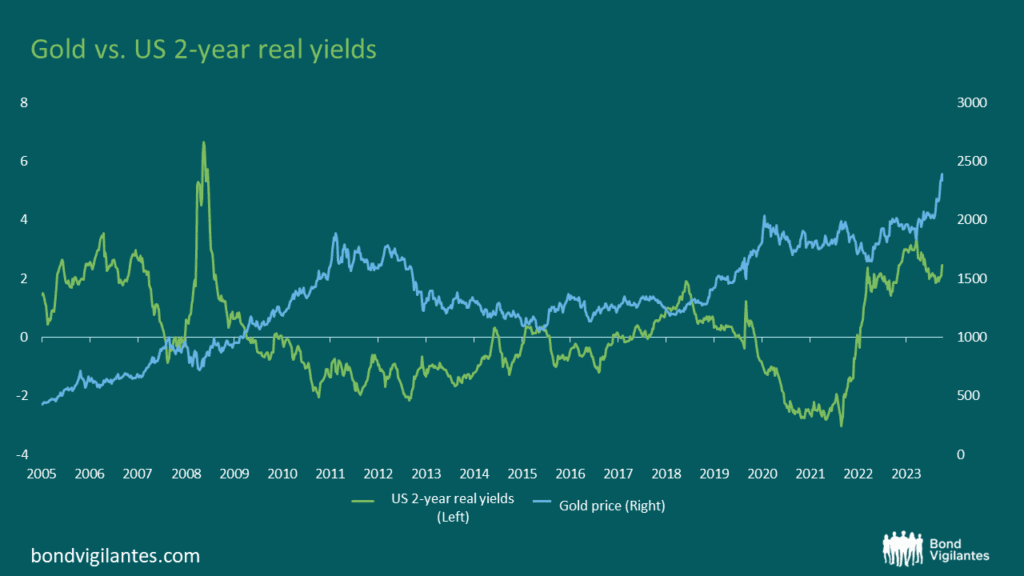

Actual yields, also referred to as inflation-adjusted yields, characterize the return on an funding after accounting for inflation. They’re calculated by subtracting the inflation price from the nominal yield of a monetary instrument, reminiscent of a authorities bond. Actual yields present a extra correct measure of an investor’s buying energy and the true return on their funding. Traditionally, gold costs have exhibited an inverse correlation with actual yields. When actual yields are low or damaging, indicating that inflation-adjusted returns on fixed-income investments are meagre or eroded by inflation, buyers search different shops of worth, reminiscent of gold. Conversely, when actual yields are excessive, providing engaging returns relative to inflation, the chance price of holding gold will increase, resulting in downward stress on the gold value.

The beneath chart demonstrates this common pattern:

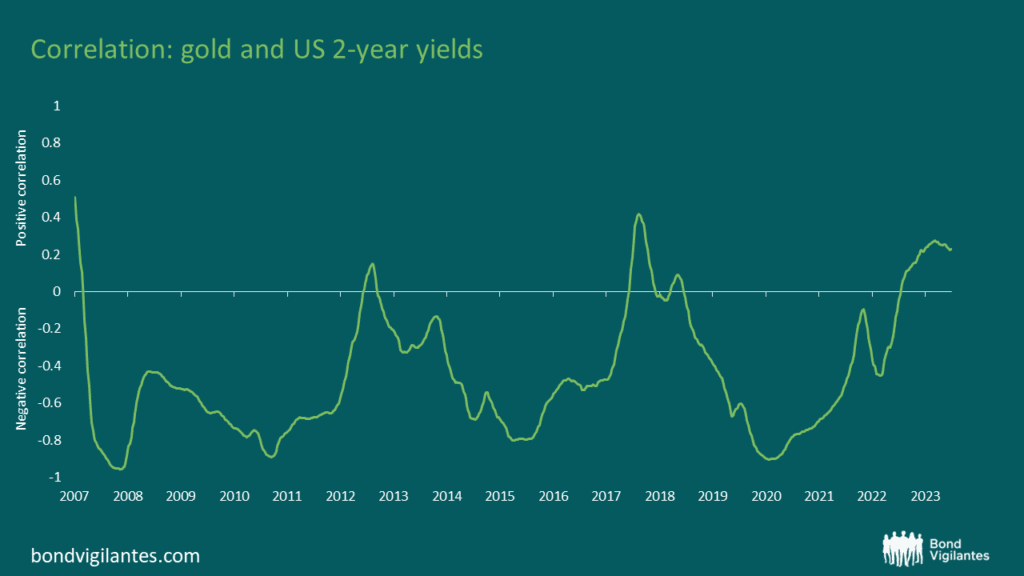

Whereas the pattern isn’t good, the next chart demonstrates that correlations have been damaging for the majority of the time:

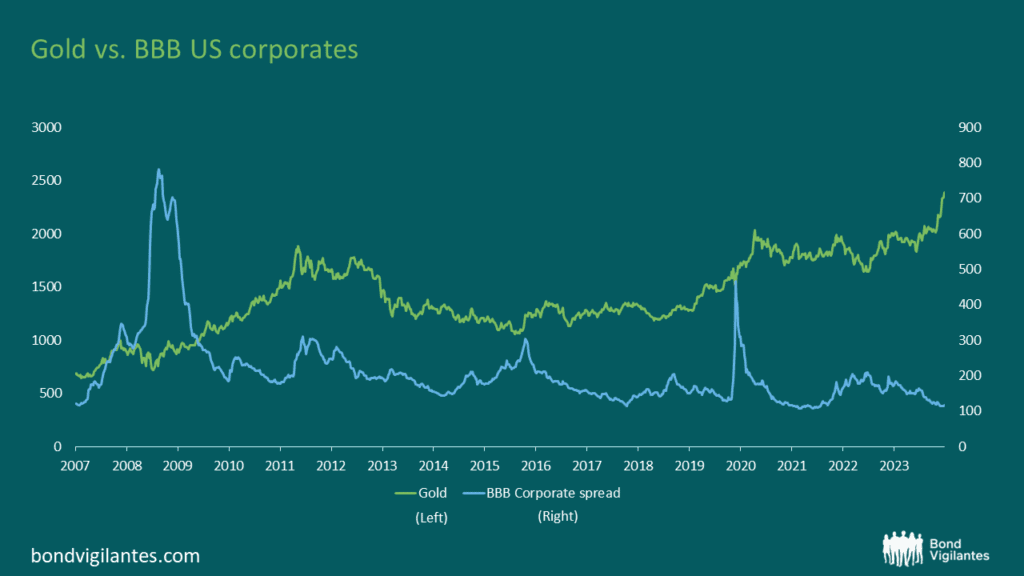

So why is gold going up? If these correlations maintain and actual yields are shifting larger, the gold value ought to be trending decrease. There’s something else at play. Traders will typically level to world instability, with geopolitical considerations being apparent. The opposite can be the difficult fiscal backdrop of many main economies, which I’ve written about. These considerations are effectively based; nonetheless, they don’t appear to be displaying up in different threat property.

BBB US corporates are buying and selling at their all-time tights, so there’s nothing to see right here:

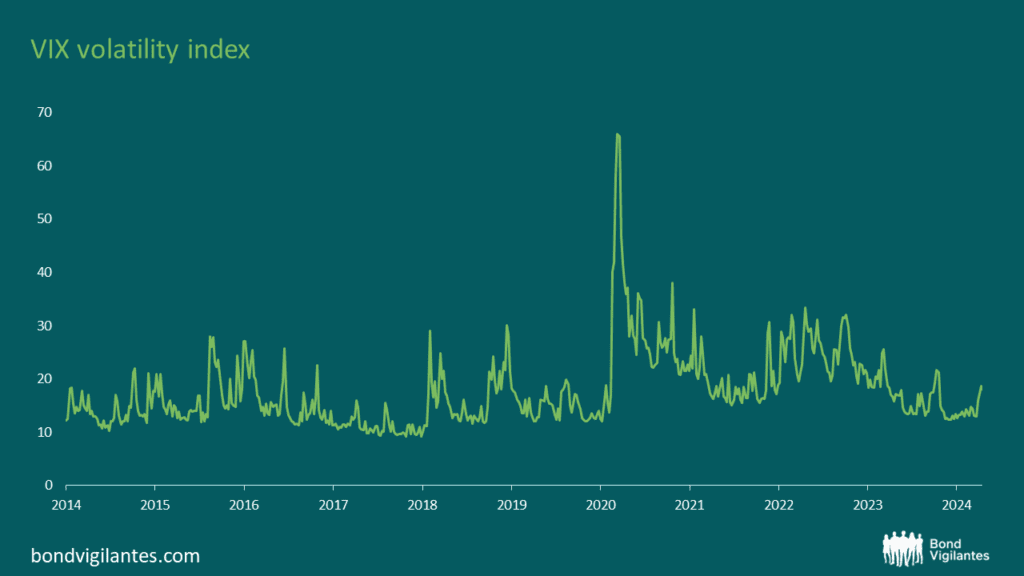

Volatility isn’t exploding, as proven by the volatility index VIX:

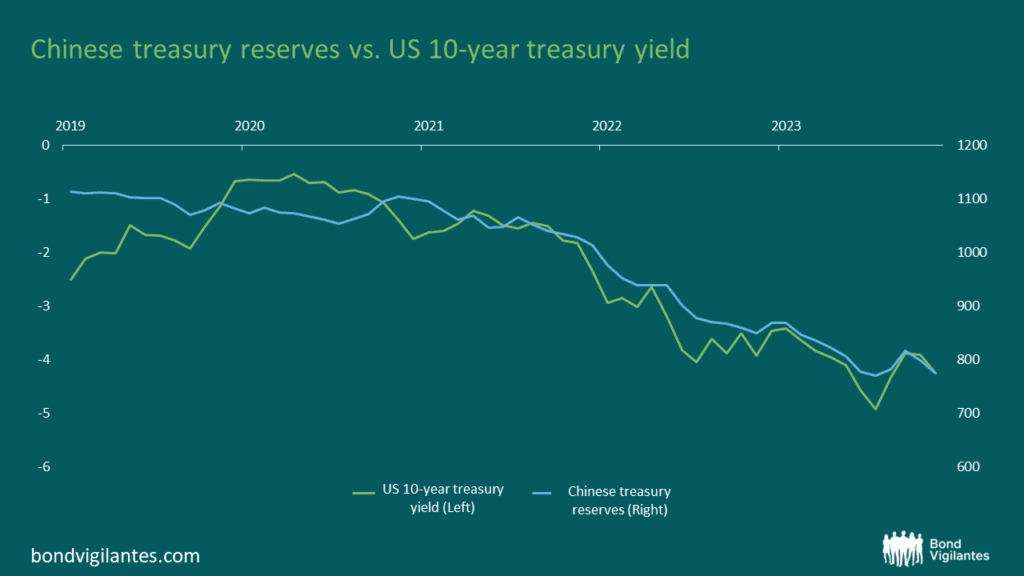

A fast have a look at China exhibits some fascinating developments. We all know why rates of interest have gone up: to fight inflation. Nonetheless, yields should be pressured larger because of nations promoting down their treasury reserves. China, for instance, has been lowering its treasury reserves for some years. This isn’t the only real cause for larger yields however will likely be a contributory issue. The beneath chart exhibits Chinese language treasury reserves falling plotted towards the 10-year treasury yield (inverted):

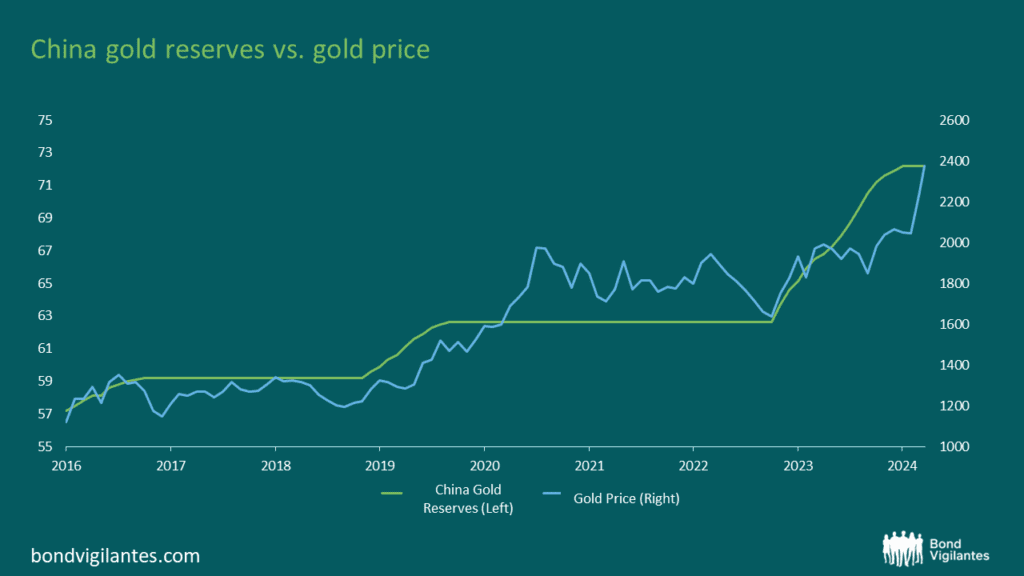

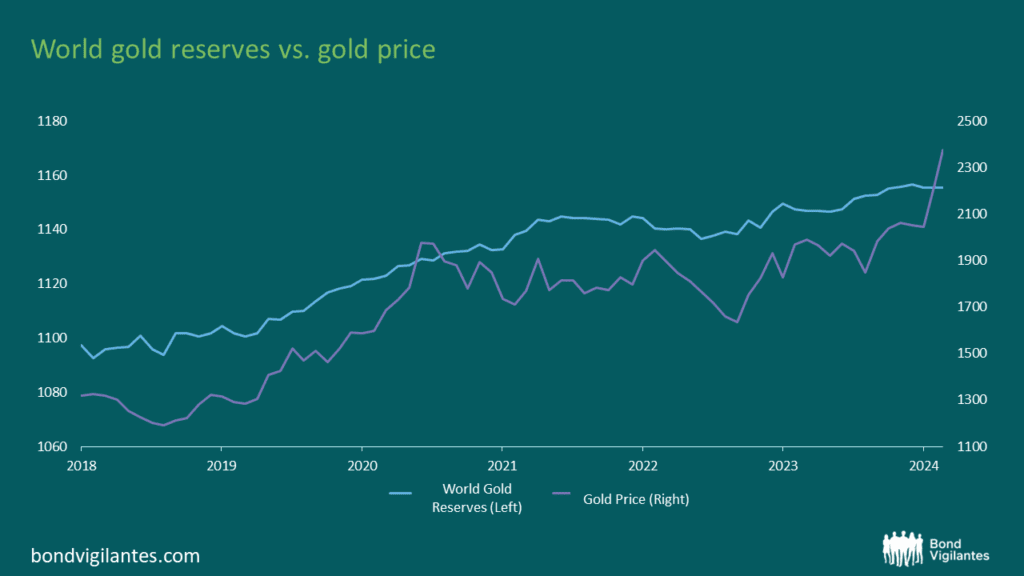

The place are these funds going? Bolstering gold reserves it could appear, and China isn’t alone on this considering:

We have now witnessed many responses with the onset of the struggle in Ukraine, considered one of which is sanctions. The sanctions have tried to lock out a rustic from its reserves. The West’s freezing of Russia’s gold and foreign exchange reserves in response to the battle seems to have triggered this shift. Extra lately, there have been threats to confiscate Russian reserves and use these funds to assist Ukraine’s efforts. It will undoubtedly make different nations considerably nervous, particularly these not 100% aligned with the West’s worldview. Clearly, the Gold value is influenced by a mess of things, and one can’t level to anyone single situation. Nonetheless, it doesn’t appear as if gold is at present being purchased for its safe-haven attraction at this stage. The place would the gold value be if the Fed begins slicing and the geopolitics worsen?