(This story is part of the cover package in the July-August issue of MJBizMagazine.)

Cannabis consumers are environmentally conscious in their purchasing decisions, but price is still the dominant factor.

According to Chicago-based cannabis data company Brightfield Group, demand for sustainable marijuana products is rising.

Brightfield research shows an increase in eco-friendly shopping preferences among marijuana consumers, with 57.1% of respondents favoring them in 2023, up from 55.9% a year earlier.

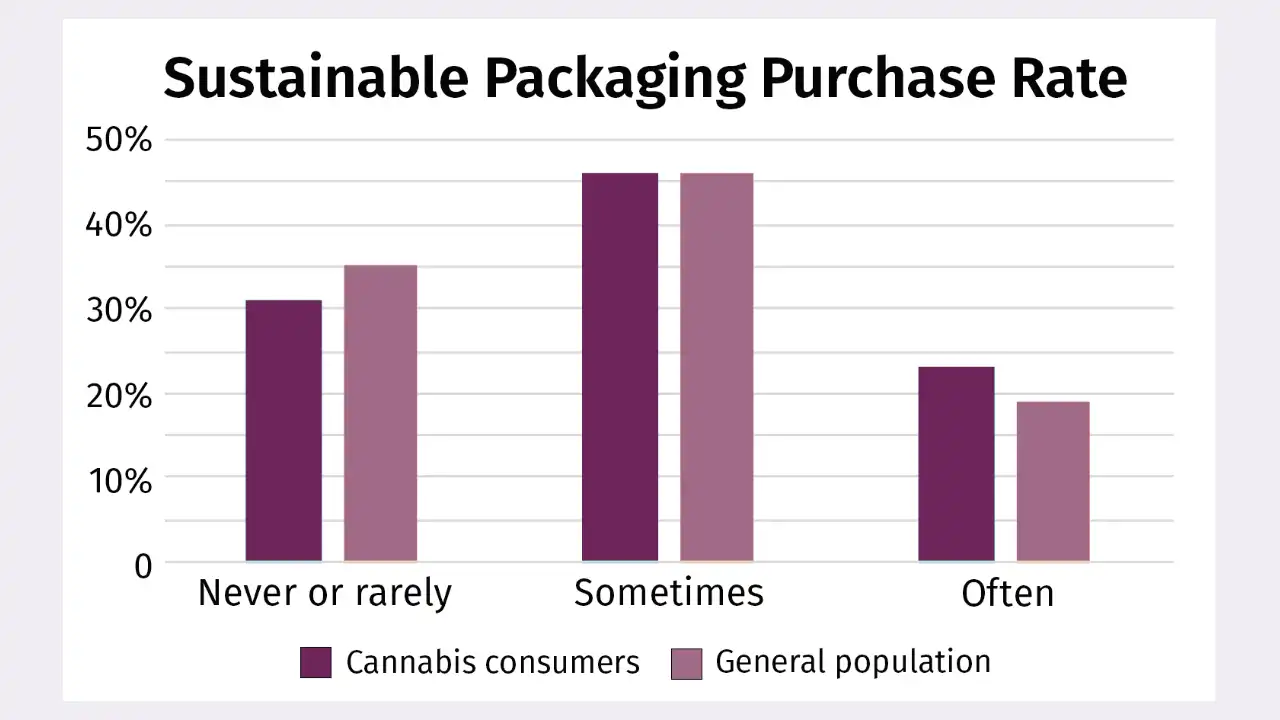

Furthermore, 69% of cannabis consumers “sometimes” or “often” purchase products with sustainable packaging, and nearly a quarter (23%) are frequent buyers.

“Cannabis consumers, in particular, are going to resonate with sustainable packaging and just sustainable practices more broadly,” said Jennifer Kregor, Brightfield’s vice president of product.

Seeking eco-friendly packaging

Cannabis consumers are attracted to all eco-friendly packaging options, including plant-based materials, biodegradable materials, plastic-free initiatives and compostable choices.

Their top packaging preferences are:

- Recyclable (49%).

- Reusable (46%).

- Plastic-free (32%).

Brightfield’s findings were based on surveys conducted last year with 21,752 census-balanced U.S. consumers and 4,786 U.S. cannabis consumers.

Cannabis costs

Citing its own research, Canadian cannabis producer Tilray Brands has suggested consumers are 50% more likely to purchase a marijuana product with sustainable packaging than one without.

However, these sentiments often are dismissed at the checkout counter if the eco-friendly products cost more, according to Joe Hodas, who was promoted to CEO of Wana Brands in April.

“Consumers really have to speak with their wallets and be loud and clear about it,” he said. “Otherwise, change doesn’t happen.”

The Colorado-based edibles maker, which sells more gummies than any other brand in the industry, for years has utilized recyclable and biodegradable product packaging.

Source: Brightfield Group Wellness Consumer 2023 data.

Disposable vapes remain popular

Despite their sustainability preferences, consumers also are driving the boom in all-in-one vape devices, which often end up in landfills.

San Francisco-based PAX Labs has made strides to develop vape pens and related accessories that can be used repeatedly by consumers, but the vape manufacturer also understands purchasing habits, the power of convenience and limitations on discretionary income.

“One of the realities of operating in the cannabis industry is that we all have to meet consumers where they are,” said Laura Fogelman, spokesperson for PAX Labs, one of the industry’s biggest producers of vaporized marijuana products and accessories.

“And one of the things that’s become really clear over the past couple years is that consumers really are gravitating towards these all-in-one devices.”

Cannabis materials costs

Cost constraints on packaging and materials – plus running a highly regulated business with steep taxes – often limits operators’ ability to initiate more sustainability practices, according to Mike Forenza, managing partner of AE Global, a Miami-based custom packaging provider for the cannabis industry.

“Every brand is saying they would definitely like to do it if it was economically or commercially viable,” he said.

Price is No. 1

According to Brightfield data, nearly two-thirds of cannabis consumers (65.3%) believe sustainable options are too expensive, though that percentage slowly has been decreasing since 2020.

Unsurprisingly, overall product price is the top factor in purchasing, with 75% of survey respondents ranking it No. 1 – well ahead of the No. 2 consideration, “desired effects.”

That cost-consciousness has led to some gaps in sustainable-packaging adoption, despite a growing commitment from consumers who extend their own sustainability practices beyond cannabis products, such as reducing waste and/or repurposing items, according to Brightfield’s Kregor.

“We’re not seeing the trends of purchasing that we’d like to for sustainability,” she said. “Finding ways to overcome the concern for price is where the hope is.”

Chris Casacchia can be reached at chris.casacchia@mjbizdaily.com.

2024 MJBiz Factbook – now available!

Exclusive industry data and analysis to help you make informed business decisions and avoid costly missteps. All the facts, none of the hype.

Featured inside:

- Financial forecasts + capital investment trends

- 200+ pages and 49 charts highlighting key data figures and sales trends

- State-by-state guide to regulations, taxes & market opportunities

- Monthly and quarterly updates, with new data & insights

- And more!