Olemedia

Investors,

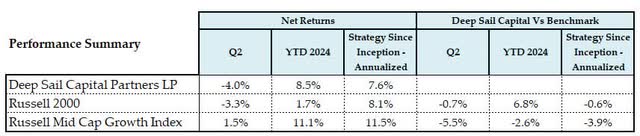

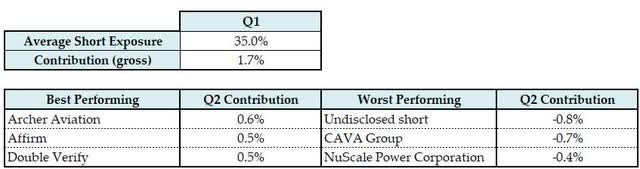

For the second quarter of 2024, Deep Sail Capital Partners (the “Fund”) returned -4% net of fees while averaging 87% net long exposure. The fund returned 8.5% net of fees year to date through the second quarter. Please consult your individual capital account statements for your individual net returns.

In the second quarter, the fund underperformed our benchmarks, the Russell 2000 index (RTY) and the Russell Mid-Cap Growth Index. For the full year 2024, the fund continued to outperform the Russell 2000, which has struggled to remain positive all year. The long portfolio saw several positions in small and microcaps trade down in Q2 as the overall market moved away from small caps. The short portfolio generated a positive return for the fund in Q2 for the second quarter in a row.

Market Commentary

| The section below written prior to July 11 th CPI report. This juxtaposition in my commentary will highlight how large of a market change occurred after the July 11 th CPI report. |

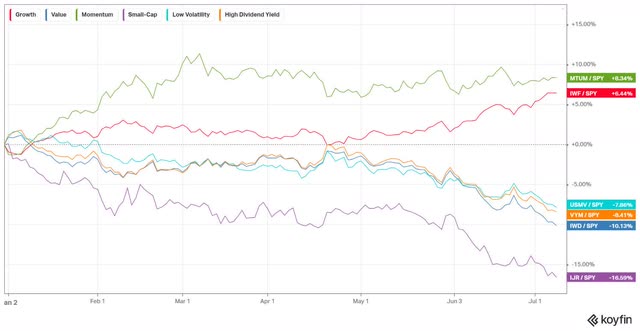

Outside of a few major technology companies, the market in Q2 saw a very muted movement. Growth and momentum factors continued to work well in Q2, driving most of the returns in the broader market, while value and small caps wildly underperformed. Small caps specifically underperformed the S&P 500 by over 5% in June alone. As has been heavily covered by financial news outlets, the “Magnificent 7” performance YTD is up 46%. This outperformance by the largest technology companies drove most of the S&P 500 (SP500, SPX) and Nasdaq returns year to date.

2024 has been a bifurcated market, where only a few mega tech stocks have done well, and the rest of the market is flat to down. The Russell 2000, as we sit right now ( July 9 th), is up just 0.4% year to date. That means the average stock in the Russell 2000 is negative year to date, and the Magnificent 7 is holding up the index. The market returns in recent months have been largely driven by the strong performance of large technology companies, especially those involved in AI. Nvidia (NVDA) stands out as a leader in the AI chip market with their H100 chips, which are an essential capex spend for anyone trying to explore an AI product. Nvidia’s stock price has more than doubled since the beginning of the year, with a year-to-date return of 122%. Below is a chart of the main market factors year to date ( thru July 9 th), which highlights this divergence.

And then we pivot. July 11 th CPI report flipped the market on its head. Small Cap Summer anyone?

Since July 11th, small and microcaps have outperformed wildly, as highlighted by the factor shown in purple in the chart above. Although this move has closed the gap between growth and momentum for the year, the Russell 2000 is still underperforming the S&P 500 by 7.5%.

Where we go from here is largely dependent on the outcome of the US election. As always, we strive to be prepared for anything and to own quality companies that can outperform regardless of the macro environment.

Long Portfolio Summary

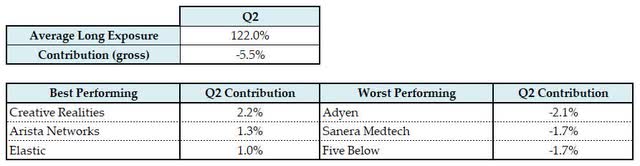

In the second quarter, the long portfolio underperformed both of our benchmarks, the Russell 2000 Index and the Russell 2000 Midcap Growth Index. This was a reversal of the significant outperformance of the long portfolio we saw in Q1. Year to date, the long portfolio continues to outperform the Russell 2000. The best-performing positions in the quarter were Creative Realities (CREX), Arista Networks (ANET), and Elastic (ESTC). Creative Realities has been the fund’s strong contributor year to date, with a year-to-date return of 100% in the first half of 2024. As discussed in the market commentary section, small caps in general underperformed throughout 2024, which impacted our long portfolio.

In Q2, the fund closed three positions and opened three new positions. The three positions that were closed as they met our valuation targets, and I found more attractive alternatives in the market. One of the new positions is Kraken Robotics, which I highlight below.

During the quarter I published a deep dive on Vertical Market Software. It can be found on the fund’s website.

Current Position: Kraken Robotics (OTCQB:KRKNF)

Kraken Robotics is a marine technology company based in Newfoundland, Canada, that develops and manufactures devices for underwater exploration, surveying, automated underwater vehicles (AUVs) and batteries. The company was founded in 2008 as Kraken Sonar Systems and through a series of mergers and acquisitions, it has since grown to become a leader in the field of marine robotics, sensors, and underwater batteries. The company sits in a unique position in the marine technology market, as there is incredible interest from governments around the world to explore autonomous underwater vehicles, and there are very few companies that have the battery and sensor technology required to build AUVs.

High Quality Business Model

Kraken Robotics offers a range of products that cater to various applications and industries, such as oil and gas, defense, ocean science, and renewable energy. Their business is broken down into three segments: sensors, batteries, and services.

Some of their main product lines are:

- KATFISH: A towed synthetic aperture sonar system that provides high-resolution seabed imagery and bathymetry.

- SEAPOWER: A pressure-tolerant battery system that can power underwater vehicles and devices for long durations.

- AQUAPIX: A miniature interferometric synthetic aperture sonar that can be integrated into various platforms, such as ROVs, AUVs, and USVs.

- ALARS: An autonomous launch and recovery system that can deploy and retrieve underwater vehicles and devices without human intervention.

Krakens pressure neutral Subsea batteries “SEAPOWER” have no known competitors that can match the depth of 6000 m at the same energy density. Their batteries were developed over the course of 15 years at ENITECH Subsea GmbH, which was acquired in 2017 by Kraken Robotics. ENITECH developed pressure-tolerant components that can operate satisfactorily under high pressure (hyperbaric or hydrostatic, such as oil baths) without the need for a highpressure enclosure. The company’s unique pressure-tolerant molding technology enables 6,000meter-rated encapsulation in silicone instead of oil-compensated or titanium pressure housings. The technology results in packaging solutions that are less expensive, more compact, lighter, and less prone to underwater corrosion and biofouling. This gives them a significant advantage over other subsea batteries on the market, as they can power underwater vehicles and sensors for longer durations and in harsher environments. Kraken’s SEAPOWER batteries are also modular, scalable, and customizable, allowing them to meet the diverse needs and specifications of various customers and applications. With their unique and valuable features, Kraken’s SEAPOWER batteries have the potential to revolutionize the subsea industry and create new opportunities and markets for the company. I believe Kraken has an extremely rare product monopoly in a niche and burgeoning underwater AUV market.

Kraken Robotics has a global presence, with offices and facilities in Canada, the United States, the United Kingdom, Germany, Denmark, and Brazil. The company employs over 250 people, including engineers, scientists, technicians, and business professionals. The company has also established partnerships and collaborations with various organizations, such as the Royal Canadian Navy, Ocean Infinity, the Royal Australian Navy, and the German Navy.

Outstanding Management

The two key figures behind Kraken Robotics’ success have been its founder, Karl Kenny, and its current CEO, Greg Reid. Kenny founded Kraken Sonar Systems back in 2008. The company was focused on software-defined sonar technology. Kenny was the CEO of Kraken after its reverse merger with Anergy Capital in 2015, which brought the company public on the Canadian Venture Exchange. Kenny later oversaw the key acquisition of ENITECH Subsea in 2017 that combined Kraken’s sensor technology with ENITECH SEAPOWER batteries and developed software, making it possible to build many of the new AUVs coming on the market now. Kenny retired and was succeeded as CEO of Kraken by Greg Reid in early 2023.

Reid has over 25 years of experience in the marine industry, with a background in engineering, management, and finance. He joined Kraken in 2015 as the chief financial officer. Under his leadership, Kraken has expanded its product portfolio, increased its revenues, raised growth capital, and strengthened its market position. As CFO, Reid has been a key decision-maker driving the company’s strategic acquisitions in recent years and scaling their existing business. While it is clear Kenney was the visionary and innovator that led Kraken to bring together the exceptionally well-positioned marine portfolio, Reid is the person to scale the business and grow it into a larger commercial organization.

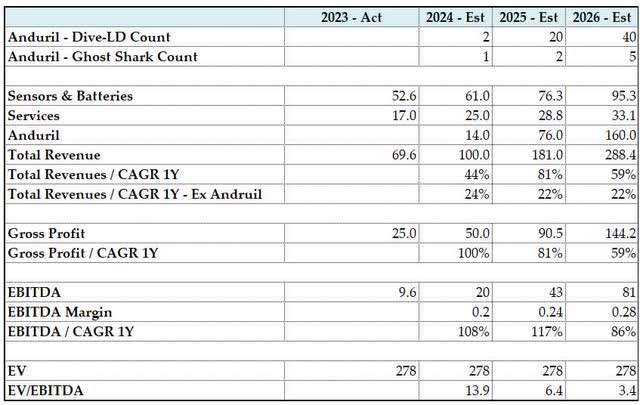

Sustainable Long Term Growth Prospects: The Anduril Dive-LD Opportunity

Anduril Industries, a VC backed defense company with billons of funding and ambitions of developing the future of robotic defense, is building a new manufacturing facility for autonomous underwater vehicles (AUVs) in Rhode Island. The facility in Quonset Point will enable large-scale production of the Dive–LD family of AUVs so that Anduril can keep ahead of customer demand, the company said in a 17 release. The facility, when fully ramped up, will be able to produce 200 Dive-LD AUVs per year. The facility is expected to open in early 2025. Each Dive-LD contains several SEAPOWER batteries, Kraken Sensors, and utilizes Kraken software to help manage both the power and sensors within the Dive-LD. In total, each Dive-LD will be equipped with $2.5m of Kraken SEAPOWER batteries and $0.5m of Kraken sensors and software. Anduril has already secured a $18.6 million contract with the US Navy to produce Dive-LD and has a co-development partnership in place with the Royal Australian Navy.

If Anduril can ramp up their Rhode Island facility to full production of 200 Dive-LD systems per year, the revenue opportunity for Kraken is ~$600 million per year. We expect that in the near term, the facility will produce between 25 and 50 Dive-LDs starting in 2025, which could be a $100 million to $250 million opportunity in the near term.

Due to the Dive-LD design already utilizing multiple products from Kraken and the lack of any competitive Deepsea batteries with an operational depth of 6000 m at similar energy density, it is highly likely that all Dive-LD systems will incorporate Kraken products. In anticipation of Anduril sourcing all the parts from Kraken for the Dive-LD, it would make sense for Kraken to set up a battery manufacturing location near the Rhode Island Anduril facility.

Kraken is an acquisition target for Anduril here, as they can pay $300m now (current market cap of Kraken * 60% premium or $1.85/share) for Kraken, or they pay them +$100m a year for the next 10 years for batteries and sensors and keep the 45% gross margins. Anduril recently raised $1.5 billion in funding at the end of last year to support their ongoing programs, so they have plenty of capital for an acquisition of this size. Small acquisitions are a core part of Anduril’s strategy, having made five acquisitions to date of small defense technology companies, including Dive Technologies, the company that developed the Dive-LD.

Extra Large AUVs

A more recent development in marine space has been the push to build large AUVs that are essentially replacements for submarines, known as Extra Large AUVs (XL-AUVs). XL-AUVs are different than smaller AUVs (like the Dive-LD) in that they have increased battery capacity, size, maneuverability, carry munitions, and allow much longer duration at sea without refueling. The main goal of XL-AUVs is to monitor, deter, and provide response capabilities for navies without having men at sea for long periods of time. Due to this fact, these XL-AUVs require large amounts of batteries. The XL AUVs are being developed globally by navies around the world and include defense contractors Boeing, Anduril, Saab AB, Kongsberg, Oceaneering, BAE Systems, and several smaller contractors.

Current XL-AUVs in development

Of note to Kraken is the Anduril Ghost Shark, which is confirmed to use $8 million of Kraken SEAPOWER batteries and sensors per vehicle. The Ghost Shark program is run as a codevelopment program between Anduril, the Royal Australian Navy, and the Australian Defense Science and Technology Group (DSTG). Under their current $90 million co-development agreement, Anduril is to deliver three Ghost Sharks by June 2025. The first was delivered ahead of schedule and on budget in April. If successful, it is likely that the Ghost Shark program will Outside of that, it is likely that a handful of other AUV manufacturers are using Kraken SEAPOWER batteries, but none have been announced. The XL-AUV segment will be a huge driver for both segments for the next 10 years.

Sensors, Services, and Batteries

Outside of the massive opportunity that Kraken has to support Anduril’s DIVE-LD and Ghost Shark programs, the companies’ other segments have strong tailwinds driven by the autonomous ambitions of western countries Navy’s. Their services business is largely driven by contracts with global navies and private ventures for offshore wind, oil and gas, and offshore infrastructure looking to complete underwater sonar surveys (via KATFISH). This business is lumpy due to contract timing and execution schedules but has been able to scale to about $20 million of anticipated revenues in 2024, up from $8 million in 2023 and $15 million in 2022. This business will likely continue to grow from here at a slower pace than the growth expected in 2024, but it will continue to expand. They do have some visibility in their service business due to the contracts lasting for multiple years once they are won with a specific navy. They do not share the backlog, but from my understanding, they are likely to expect double-digit growth from the 2024 level.

The subsea batteries and sensors segment outside of Anduril will continue to grow rapidly.

Kraken has released press releases highlighting their subsea battery sales. It is clear that Kraken have other demand outside of Anduril. In Kraken’s Q1 revenue press release, the company provided 2024 revenue guidance of $90-100 million. Of that $100 million, roughly $80 million is expected to be batteries and sensors, which implies significant growth in 2024 and over $56 million in 2023.

The market for Kraken’s products is still in its infancy, but I believe that due to their position in the battery market, the company could see significant growth due to the overall growth of the AUV market over the next 10 years. Kraken could easily become a multi-billion-dollar defense contractor in a few short years.

Reasonable Valuation

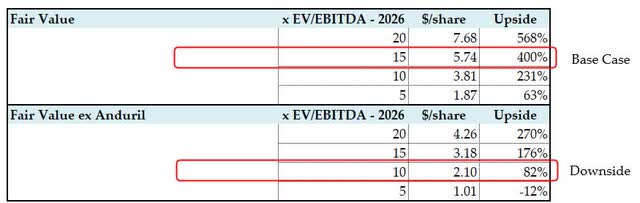

With the backdrop of understanding the position in which Kraken currently sits in Deepsea Batteries, it is easy to come up with a huge valuation for the company when their counterparty opportunity with Anduril could be ~$400-$800m/year. But that opportunity is clearly still years away and depends largely on the demand for Dive-LD AUVs and the success of the Ghost Shark program. We took the approach of valuing the company with and without the Anduril opportunity to see if the Anduril opportunity is never realized and if the outcome is still positive.

Kraken Robotics – Forecast – $m CAD

Kraken Robotics – Valuation

In the base case, we modeled the Andruil opportunity at a modest 40 Dive-LD/year run rate in 2026 and 5 Ghost Shark deliveries. Under that scenario, shares of Kraken will be valued at $5.74 per share in 2026, which is 400% upside to the current price of $1.15 per share, or a 90% IRR over 2.5 years. In the downside case, we modeled the business without any Anduril revenue. Under that scenario, shares of Kraken will be valued at $2.1/share in 2026, which is 82% upside to the current price of $1.15/share, or a 27% IRR over 2.5 years. An upside case could easily be modeled at 4x the value of the base case if you believe Andruil scales their Dive-LD production and expands their Ghost Shark program. In conclusion, I believe that with the unique position in which Kraken sits in a burgeoning industry and a line of sight to a potentially large opportunity in front of it, Kraken is an excellent investment at the current value of 13.9x 2024 EBITDA.

Short Portfolio Summary

Affirm Holdings (AFRM), the Buy Now, Pay Later (‘BNPL’) consumer lender, continued to perform well in Q2 and became our second-best-performing short behind Archer Aviation (ACHR). A few short positions in recent IPOs have not reacted like we expected and have been observed post-IPO historically. Cava Group (CAVA) and ARM Holdings (ARM) both IPOed in 2023 and have since both returned over 100%. I believe eventually the IPO shine will come off of both stocks as insiders and early IPO investors evaluate if both are warranted the massive valuations they currently have (CAVA = 52x 2026 EBITDA, ARM = 60x 2026 EBITDA).

During Q2, many shorts performed well in our portfolio, with 61% of our shorts generating a positive contribution. At the end of Q2, the opportunity set for shorts was diminished, but the recent spike in small caps has presented several attractive short entities that we expect to benefit from the short portfolio in the back half of 2024.

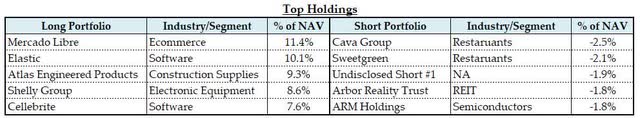

Top Holdings & Current Exposure

At the end of the second quarter the fund held 22 long positions and 33 short positions. The fund ended the quarter with an exposure of 124% long and 38% short or an 86% net long exposure.

Sincerely,

Sean

|

Disclaimer Deep Sail Capital LLC (“Deep Sail Capital”) is an investment adviser to funds that are in the business of buying and selling securities and other financial instruments. This information is provided for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associate subscription documents. Past performance is no guarantee of future results. “Deep Sail Capital Partners” returns in this document are shown as net returns or gross returns where stated. Historical net returns assume a 1.5% and 15% management and performance fee, respectively. For Net Returns of fees and expenditures figures please reach out to the fund manager at the email info@deepsailcapital.com. “Deep Sail Capital LLC” name was changed on April 7th 2022 from the previous name “Organon Capital LLC”. “Deep Sail Capital Partners LP” name was changed on April 6th 2022 from the previous name “Westropp Funds LP”. * – “Strategy Since Inception” refers to the Strategy inception date of July 2016. Deep Sail Capital Partners LP’s predecessor incubator fund, “Westropp Funds LP” pivoted from a Value Investment style to a Growth at a Reasonable Price (GARP) style fund on that date. For more details on this transition or the calculation behind the “Strategy Since Inception” returns please reach out to the fund manager at info@deepsailcapital.com. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.