Nvidia (NYSE: NVDA) which was anyway the best-performing S&P 500 inventory in 2023 is up sharply in US premarket worth motion in the present day and appears set to hit a brand new document excessive as markets give a thumbs as much as its fiscal second quarter 2023 earnings. Wall Road analysts have additionally raised the inventory’s goal worth after the stellar earnings report.

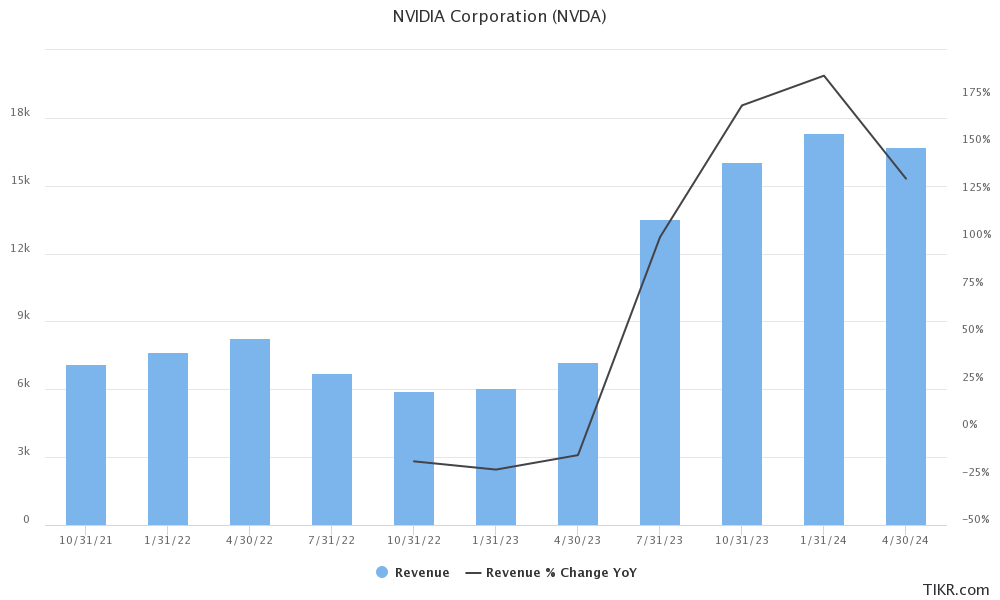

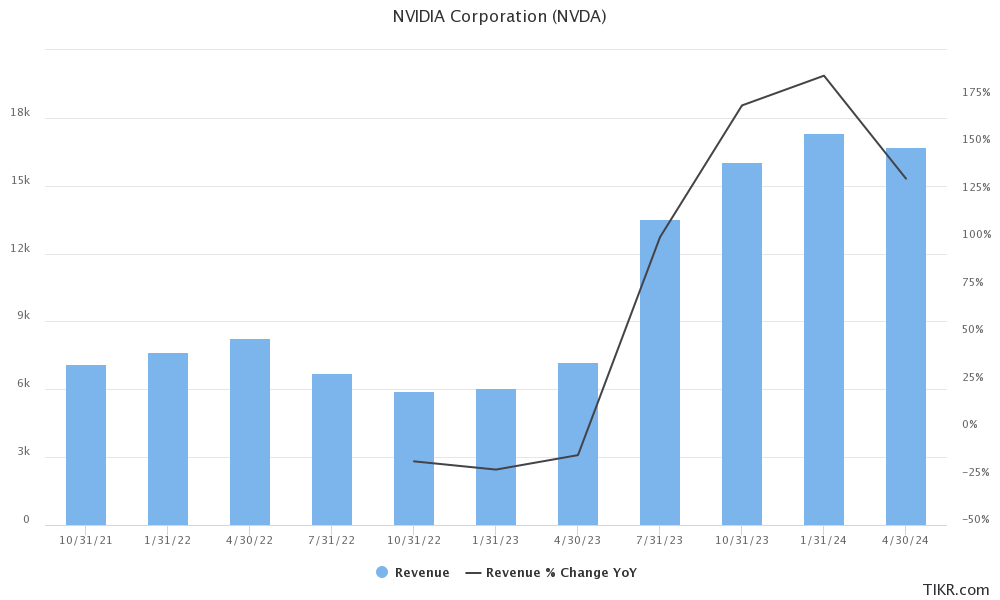

Nvidia reported revenues of $13.51 billion within the quarter that ended on July 30 which have been up 101% YoY and a brand new quarterly document for the corporate. The revenues are additionally properly forward of the $11 billion that the corporate forecasted in the course of the fiscal first-quarter earnings name.

By the way, even the Q2 income steerage that NVDA supplied in the course of the fiscal Q1 earnings name was over 50% larger than what analysts have been anticipating.

The corporate’s EPS got here in at $2.70 which was once more forward of the $2.09 that analysts anticipated.

Nvidia inventory rises after earnings beat estimates

Together with posting better-than-expected fiscal Q2 revenues, Nvidia guided for revenues of $16 billion within the fiscal third quarter which suggests a YoY income progress of 170% and is properly forward of the $12.61 billion that analysts have been anticipating. Notably, even essentially the most optimistic forecast known as for revenues of round $14 billion, and Nvidia but once more shattered analysts’ estimates by a large margin.

Jensen Huang, NVDA’s CEO stated throughout his ready remarks that “A brand new computing period has begun. Corporations worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

He added, “NVIDIA GPUs related by our Mellanox networking and change applied sciences and operating our CUDA AI software program stack make up the computing infrastructure of generative AI.”

Notably, Nvidia’s A100 and H100 AI chips are utilized in generative AI purposes like ChatGPT and the demand for these chips has skyrocketed amid the AI increase as a number of corporations are engaged on generative AI fashions.

AI is a serious alternative for NVDA

Huang – who was fairly bullish on AI in the course of the earlier earnings name – sounded much more optimistic this time round and stated in the course of the earnings name “The world has one thing alongside the traces of a couple of trillion {dollars} value of knowledge facilities put in, within the cloud, enterprise and in any other case.”

He burdened, “That trillion {dollars} of knowledge facilities is within the means of transitioning into accelerated computing and generative AI.”

Amid the robust demand for chips for generative AI, Nvidia’s Information Middle revenues rose 171% YoY to $10.32 billion. Wanting on the different segments, Gaming revenues rose 22% to $2.49 billion whereas Skilled Visualization revenues rose 24%. Gaming was as soon as the most important income driver for Nvidia however issues have modified drastically over the past yr. Whereas the corporate’s Gaming revenues fell amid falling PC gross sales, its knowledge heart gross sales have soared.

The corporate’s Automotive section – which it sees as a key driver of its long-term progress – additionally reported a 15% YoY rise in revenues,

That stated, whereas the opposite segments reported a double-digit rise in revenues which in any other case seems good on a standalone foundation, the efficiency fades in entrance of the Information Middle section whose efficiency has been splendid.

NVDA introduced a inventory buyback

In the course of the quarter, Nvidia repurchased $3.28 billion value of its shares and stated that its board has licensed one other $25 billion inventory buyback program. Corporations normally repurchase their shares once they discover them undervalued.

Nvidia on menace of China export ban

Final yr, the US imposed restrictions on exports of a number of chips to China together with Nvidia’s A100. The corporate nevertheless managed to avoid the ban by promoting A800 chips to China whose efficiency was beneath the bounds that the Commerce Division had set.

Markets have been involved that the Biden administration would possibly ban exports of extra high-end tech merchandise to China.

In the course of the earnings name, Nvidia tried to downplay the specter of a China export ban and the corporate’s CFO Colette Kress stated, “We imagine the present regulation is attaining the supposed outcomes.”

She emphasised, “Given the energy of demand for our merchandise worldwide, we don’t anticipate that further export restrictions on our knowledge heart GPUs, if adopted, would have a direct materials impression to our monetary outcomes.”

Wall Road analysts get much more bullish on NVDA inventory

Wall Road analysts, who have been anyhow getting bullish on NVDA inventory forward of the earnings acquired much more optimistic concerning the chip large after its fiscal Q2 earnings launch.

Stifel analyst Ruben Roy who had upgraded the inventory from a maintain to purchase forward of the earnings raised his goal worth to $600 after the earnings launch and stated, “we underestimated the chance associated to the potential shift of $1 trillion of put in knowledge heart infrastructure from normal function compute to accelerated compute architectures.”

Wells Fargo analyst Aaron Rakers additionally raised his goal worth to $600 whereas Goldman Sachs which had raised Nvidia’s goal worth final month solely raised it additional to $605.

Goldman Sachs analyst Toshiya Hari stated, “We acknowledge rising competitors from the big cloud service suppliers (i.e., captive/inner options) in addition to different service provider semiconductor suppliers.”

Hari added, “we count on Nvidia to keep up its standing because the accelerated computing business commonplace for the foreseeable future given its aggressive moat and the urgency with which clients are growing/deploying more and more advanced AI fashions.”

Nvidia’s earnings attracted outsized consideration from the markets because the inventory had greater than tripled in 2023 amid the AI euphoria. The corporate didn’t disappoint bulls and posted yet one more quarter of spectacular earnings whereas offering steerage that surpassed estimates by a large margin.

Nvidia inventory is up nearly 7% in premarkets and appears set to strengthen its place as the most important S&P 500 gainer in 2023.

Trusted & Regulated Inventory & CFD Brokers

What we like

-

0% Charges on Shares -

5000+ Shares, ETFs and different Markets -

Accepts Paypal Deposits

Cost per Commerce

Zero Fee on actual shares

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to take into account whether or not you’ll be able to afford to take the excessive threat of shedding your cash.

Out there Property

- Whole Variety of Shares & Shares5000+

- US Shares

- German Shares

- UK Shares

- European

- ETF Shares

- IPO

- Funds

- Bonds

- Choices

- Futures

- CFDs

- Crypto

Cost per Commerce

-

FTSE 100

Zero Fee -

NASDAQ

Zero Fee -

DAX

Zero Fee -

Fb

Zero Fee -

Alphabet

Zero Fee -

Tesla

Zero Fee -

Apple

Zero Fee -

Microsoft

Zero Fee

Deposit Technique

- Wire Switch

- Credit score Playing cards

- Financial institution Account

- Paypall

- Skrill

- Neteller

Disguise Charges

View Charges

What we like

-

Enroll in the present day and get $5 free -

Fractals Out there -

Paypal Out there

Cost per Commerce

$1 to $9 PCM

Investing in monetary markets carries threat, you have got the potential to lose your whole funding.

Out there Property

- Whole Variety of Shares999

- US Shares

- German Shares

- UK Shares

- European Shares

- EFTs

- IPOs

- Funds

- Bonds

- Choices

- Futures

- CFDs

- Crypto

Cost per Commerce

-

FTSE 100

$1 – $9 monthly -

NASDAQ

$1 – $9 monthly -

DAX

$1 – $9 monthly -

Fb

$1 – $9 monthly -

Alphabet

$1 – $9 monthly -

Telsa

$1 – $9 monthly -

Apple

$1 – $9 monthly -

Microsoft

$1 – $9 monthly

Deposit Technique

- Wire Switch

- Credit score Playing cards

- Financial institution Account

Disguise Charges

View Charges